Executive Summary

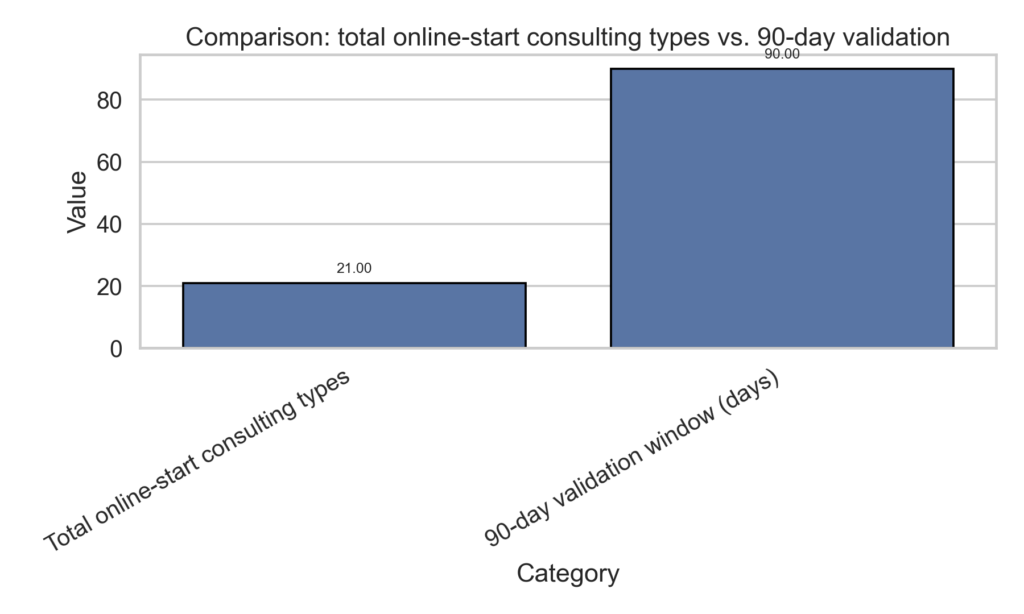

This guide maps 20+ online consulting types into practical profiles you can act on this quarter. It pairs typical deliverables, client profiles, engagement size, fees, success metrics, and entry barriers with a clear path to pick a niche quickly and validate it in 90 days. You’ll see how enterprise, growth, and specialty disciplines line up for freelancers and small firms, including cross-cutting hybrids like AI-enabled transformations. The aim is to help you choose a niche you can credibly own, price effectively, and land your first paid pilot fast.

1. Quick start: how to use this guide

This quick-start section sets the frame: you’ll find a concise taxonomy of 20+ online consulting types, each with a compact profile you can scan and compare. The goal is a repeatable framework you can reuse as your business grows—from selecting a niche to sizing engagements and designing a fast 90-day validation plan. You’ll practice reading type profiles, applying a scoring framework, and launching your first test engagement with real clients.

1.1 What you’ll get from this outline

From this outline you’ll extract a ready-to-use taxonomy of 20+ online-start consulting types, each with a compact profile you can study or share with potential clients. You’ll gain a practical view of typical delivery patterns, ideal client profiles, engagement size, and fees, plus the KPIs that matter most in each domain. Most importantly, you’ll get a fast, repeatable method to narrow your focus, run a 90-day market test, and align marketing, pricing, and proposals with what clients actually value.

- A concise taxonomy you can reference in pitches and proposals.

- Clear entry barriers so you know which niches fit your background and where you’ll struggle to get started.

- A practical 90-day plan to test a chosen niche and refine your approach.

- A KPI-driven framework you can track to demonstrate impact to clients.

1.2 How to read the type profiles

Each type profile is designed to be compact but informative. You’ll find the core deliverables, the typical client and engagement model, the expected size and duration, price ranges, KPIs that signal success, and the prerequisites or entry barriers. Profiles are written to be skimmable for quick comparisons, while still offering enough nuance to assess fit with your background and ambitions. The aim is to reveal where you can add immediate value and what you’d need to build or partner to deliver it well.

- Deliverables describe concrete outputs you’ll produce.

- Target clients/engagement model signal who buys and how you’ll work.

- Size/Timeline and typical fees anchor pricing and project duration.

- KPIs show the measurable impact clients care about.

- Prereqs/entry barriers reveal credibility, data access, or credentials you may need.

1.3 How to pick a niche quickly (scoring framework)

Choosing a niche doesn’t have to be overwhelming. Use a simple, data-driven rubric that weighs market demand, your domain strength, pricing potential, time-to-value, and competition. Apply weights that reflect your priorities—if you want fast momentum, give more weight to time-to-first-win and early client adoption. Run a 90-day test plan to validate your top pick: define an ICP, a minimal viable offering, and a pilot that yields tangible outcomes. The result is a defensible niche you can scale.

- Create a scoring rubric (0–10 per criterion) for market demand, fit, pricing power, entry barriers, and time-to-value.

- Run a 90-day test plan with a single, well-defined target client and a minimal engagement to prove viability.

- Use early client results to refine positioning, messaging, and go-to-market.

2. Group A: Core enterprise advisory disciplines (Types 1–7)

This group focuses on strategy and transformation at scale. Work tends to require credibility with senior leadership, access to data, and the ability to drive measurable financial and strategic outcomes. These types establish a durable backbone for a high-value practice and are highly scalable through playbooks, governance frameworks, and repeatable methodologies.

2.1 Type 1 — Strategy Consulting

Delivers: corporate strategy, growth options, market sizing, roadmaps, portfolio optimization

Clients/Engagements: C-suite; large to mid-market

Size/Timeline: 2–12 months

Fees: $150k–$1.5M

KPIs: ROI uplift, ROIC, payback period, market share gains

Prereqs: strong problem-framing, data access, senior client trust

Strategy work helps executives decide where to invest, divest, or reorganize for maximum value. You’ll map options, quantify trade-offs, and craft roadmaps that align with long-term objectives. Practically, you’ll run workshops, socialize scenarios with leadership, and define milestones that translate strategy into action. Your credibility hinges on crisp problem-framing, credible data anchors, and a narrative that translates complex analytics into executable bets.

Deliverables include scenario plans, market-sizing models, option trees, and an implementation roadmap. The engagement tends to be episodic and executive-level, with multiple stakeholders. A practical tip: build a lightweight decision framework early to structure discussions and accelerate buy-in.

2.2 Type 2 — Management / Operations Consulting

Delivers: operating model, process optimization, dashboards, cost/efficiency programs

Clients/Engagements: operations-heavy firms; mid-to-large

Size/Timeline: 3–12 months

Fees: $150k–$2M

KPIs: cost reductions %, cycle-time gains, operating income impact, time-to-value

Prereqs: process literacy, change management capability

Operations work targets efficiency and effectiveness. You’ll map current operating models, identify bottlenecks, and implement changes that cascade across the organization. The best practitioners pair measurement discipline with dashboards and governance to keep transformation on track. The heart of this work is converting insights into rapid, measurable improvements in cost, speed, and quality. A practical hint: pair process redesign with a robust change-management plan to boost adoption and outcomes.

Deliverables include redesigned operating models, process playbooks, KPI dashboards, and cost-optimization plans. Engagements blend advisory guidance with hands-on implementation to ensure momentum and accountability.

2.3 Type 3 — IT / Technology / Digital Transformation

Delivers: IT strategy, systems architecture, ERP/CRM, cloud, cybersecurity, digital roadmaps

Clients/Engagements: mid-market to large enterprises

Size/Timeline: 3–18 months

Fees: $200k–$3M

KPIs: project ROI, time-to-value, system effectiveness (uptime/adoption), security posture

Prereqs: tech credibility, vendor-neutral approach

Technology-centric transformations sit at the intersection of business and IT. You’ll define strategy, select platforms, and oversee modernization of core systems to unlock agility and efficiency. A vendor-neutral stance helps you tailor architectures and roadmaps to client needs rather than a fixed ecosystem. Governance, risk assessment, and interoperability across domains are common, so you’ll need comfort working with multiple functions (finance, HR, operations). Practical tip: establish a governance framework early to prevent scope creep.

Deliverables include technology strategy, ERP/CRM roadmaps, cloud adoption plans, and cybersecurity posture improvements. Engagements mix advisory and program-management components to move ideas into actionable programs.

2.4 Type 4 — Financial Advisory / Corporate Finance

Delivers: diligence, financial modeling, value creation, capital structure, financing plans

Clients: corporate, PE-backed, large family offices

Size/Timeline: 1–12 months

Fees: $150k–$2M

KPIs: NPV/ROI of deals, synergy realization, financing-cost reductions

Prereqs: solid modeling, regulatory awareness

Financial advisory work centers on the financial engineering behind transactions and value creation. You’ll build robust valuation models, assess deal feasibility, and shape capital plans that optimize ownership structure and funding sources. Deliverables span diligence reports, valuation models, integration synergies, and financing strategies. The key is translating rigorous analysis into decisions that improve deal outcomes and funding costs.

2.5 Type 5 — Mergers & Acquisitions (M&A) Advisory

Delivers: target screening, due diligence, deal structuring, integration planning

Clients/Engagements: buyers/sellers, PE firms

Size/Timeline: 2–18 months

Fees: $200k–$3M

KPIs: deal value uplift, synergy capture, integration velocity

Prereqs: deal experience, cross-functional access

M&A advisory requires speed, rigor, and broad cross-functional access. You’ll screen targets, conduct diligence, structure deals, and plan integrations that maximize realized value. Success hinges on a blend of financial acumen and operational insight, plus strong relationships with deal teams and senior executives. Deliverables include due-diligence packs, deal models, integration roadmaps, and synergy tracking dashboards.

2.6 Type 6 — HR / Organization Design

Delivers: org design, talent strategy, leadership development, culture change

Clients: mid-market to large; often post-merger

Size/Timeline: 1–9 months

Fees: $120k–$1.5M

KPIs: time-to-prod productivity, retention, payback on talent investments

Prereqs: change-management capability, stakeholder buy-in

HR and organization design work blends strategy with people-and-change execution. You’ll design structures, develop talent strategies, and lead leadership-development programs to anchor culture and performance gains. This type often follows big transformations, where leadership alignment and capability-building drive the sustainability of benefits. Deliverables include org designs, talent roadmaps, leadership programs, and culture-change plans.

2.7 Type 7 — Change Management

Delivers: change strategy, communications, adoption plans, training

Clients: any large transformation

Size/Timeline: 3–12 months

Fees: $100k–$1.8M

KPIs: adoption rates, productivity lift, NPS post-change

Prereqs: cross-functional access, sponsor alignment

Change management anchors transformations by ensuring people, processes, and systems move in sync. You’ll craft change strategies, communications plans, adoption roadmaps, and training to drive real usage and benefits realization. A practical approach combines stakeholder mapping, compelling storytelling, and measurable adoption targets to keep leadership aligned and energized.

3. Group B: Growth, data & digital enablement (Types 8–14)

This group focuses on growth acceleration, data governance, and practical digital enablement. Engagements are often more execution-focused than pure strategy, with a strong emphasis on measurable outcomes and clear dashboards. Hybrids across marketing, analytics, and risk disciplines are common, enabling faster cycles and sharper experimentation.

3.1 Type 8 — Marketing, Growth & Customer Experience

Delivers: GTM strategy, pricing, segmentation, lifecycle optimization, CX improvements

Clients/Engagements: startups to large firms

Size/Timeline: 2–12 months

Fees: $100k–$1.5M

KPIs: CAC/LTV, revenue growth, NRR, NPS

Prereqs: data access, marketing/UX exposure

This type blends growth marketing with customer experience improvements. You’ll craft go-to-market plans, pricing strategies, and segmentation that unlock higher retention and monetization. Practical steps include mapping the funnel, testing pricing experiments, and aligning CX improvements with measurable revenue gains. Deliverables typically include marketing roadmaps, pricing models, segmentation schemes, and CX improvement playbooks.

3.1 Type 9 — Sales & Go-To-Market (GTM)

Delivers: sales process design, enablement, territory alignment, incentive design

Clients/Engagements: B2B, B2B2C; mid-market to enterprise

Size/Timeline: 1–9 months

Fees: $100k–$1.5M

KPIs: win-rate, cycle time, quota attainment, ramp time

Prereqs: access to sales data, buy-in from sales leadership

Sales and GTM focus on building or improving the spine of revenue generation. You’ll design or optimize sales processes, enablement programs, and incentive structures that accelerate new-market wins. Deliverables include sales playbooks, territory plans, and incentive models, plus dashboards showing pipeline velocity and close rates.

3.1 Type 10 — Data, Analytics & AI

Delivers: data strategy, governance, analytics platforms, dashboards, basic AI/ML pilots

Clients: data-ready organizations

Size/Timeline: 2–12 months

Fees: $150k–$2M

KPIs: speed of insight, adoption, KPI improvements

Prereqs: data access, data literacy

This profile emphasizes turning data into decision-ready insights. You’ll establish data strategies, governance, and analytics platforms, then pilot simple AI/ML initiatives to demonstrate value. Deliverables include data governance policies, data catalogs, dashboards, and pilot results. The practical path is to prove value with quick wins that convert data initiatives into ongoing programs.

3.2 Type 11 — AI Strategy & AI Implementation

Delivers: AI strategy, use-case prioritization, tool selection, pilot-to-scale plans, governance

Clients: any data-enabled business

Size/Timeline: 3–18 months

Fees: $200k–$3M

KPIs: AI ROI, time-to-value, model quality, governance maturity

Prereqs: domain knowledge, vendor independence

AI strategy blends business context with technical prioritization. You’ll prioritize use cases, select tools, and design governance to scale from pilot to enterprise adoption. The implementation component ensures pilots translate into production capabilities. A practical move: couple AI initiatives with governance practices to manage risk and align with regulatory expectations.

3.2 Type 12 — Risk, Compliance & Governance

Delivers: risk assessments, controls design, governance frameworks, audit readiness

Clients: regulated industries (FS, healthcare, energy)

Size/Timeline: 2–12 months

Fees: $150k–$2M

KPIs: control effectiveness, fewer audit findings, regulatory fines avoided

Prereqs: regulatory understanding, independence

Risk and governance work helps clients navigate complex regulatory landscapes. You’ll conduct risk assessments, design controls, and build governance frameworks to improve compliance and reduce exposure. Deliverables include risk registers, control matrices, governance charters, and audit-readiness playbooks.

3.2 Type 13 — Sustainability, ESG & Environmental

Delivers: ESG strategy, reporting, carbon footprint reduction, roadmaps

Clients/Engagements: public companies, brands under ESG pressure, mid-market manufacturers

Size/Timeline: 3–12 months

Fees: $100k–$1.5M

KPIs: emissions reductions, reporting completeness, investor-grade metrics

Prereqs: knowledge of GHG accounting and ESG frameworks

Sustainability and ESG work helps firms align with stakeholder expectations and regulatory trends. You’ll define strategies, implement reporting, and chart roadmaps to reduce environmental impact while meeting investor and public-sector expectations. Deliverables include ESG policies, reporting templates, and reduction roadmaps.

3.3 Type 14 — Supply Chain & Procurement

Delivers: procurement optimization, supplier risk, network design, inventory optimization

Clients/Engagements: manufacturing, retail, logistics-heavy firms

Size/Timeline: 2–12 months

Fees: $150k–$2M

KPIs: COGS reductions, service levels, working capital impact

Prereqs: access to procurement data, supplier ecosystem

Supply chain and procurement work aims to lift efficiency and resilience. You’ll optimize supplier networks, reduce costs, and improve service levels. Deliverables include supplier-risk dashboards, network-design models, and procurement playbooks. Quick wins often come from tightening inventory policies and clarifying supplier performance metrics.

4. Group C: Specialty & sector-focused disciplines (Types 15–20+)

This final group concentrates on domain-specific depth. A well-chosen specialty enables premium pricing and tighter client fit, often delivering repeatable value with defensible market positioning. Use these anchors to pilot one or two specialties in your first 90 days and build a credible case study library.

4.1 Type 15 — Procurement & Sourcing

Delivers: strategic sourcing, supplier negotiations, category management

Clients/Engagements: global/regional procurement teams

Size/Timeline: 1–9 months

Fees: $100k–$1.5M

KPIs: savings realized, supplier performance improvements

Prereqs: negotiation credibility, data access

Strategic procurement work focuses on negotiated savings and supplier performance. You’ll run category analyses, optimize supplier portfolios, and implement savings initiatives with measurable results. Deliverables include savings plans, supplier scorecards, and negotiation playbooks.

4.1 Type 16 — Product & Innovation

Delivers: product strategy, roadmap, portfolio pruning, rapid experimentation

Clients: tech, manufacturing, consumer brands

Size: 2–12 months

Fees: $150k–$2M

KPIs: time-to-market, feature adoption, revenue per product

Prereqs: hands-on product-management experience

Product and innovation work drives market-relevant offerings. You’ll shape product portfolios, prioritization, and test-driven development with rapid experiments. Deliverables include product roadmaps, feature-prioritization matrices, and experiment dashboards.

4.1 Type 17 — Pricing & Revenue Optimization

Delivers: pricing architecture, models, discounting rules, promo optimization

Clients: SaaS, B2C/B2B2C, manufacturing

Size: 1–9 months

Fees: $100k–$1.5M

KPIs: gross margin, revenue lift, price realization

Prereqs: pricing analytics capability, data access

Pricing and revenue optimization translates data-driven insights into practical pricing policies. You’ll design pricing architectures, discounting rules, and promotional controls, delivering measurable margin and revenue uplift. Deliverables include price calendars, discounting rules, and value-based pricing playbooks.

4.2 Type 18 — Branding, Communications & Public Relations

Delivers: brand refresh, messaging, media strategy, crisis comms

Clients: consumer brands, B2B brands, public-sector

Size: 1–6 months

Fees: $75k–$1M

KPIs: brand equity, share of voice, engagement

Prereqs: creative credibility, media relationships

Branding and communications help organizations articulate a compelling story and protect reputation. You’ll refresh positioning, craft messaging, and design PR and crisis communications strategies. Deliverables include brand-guidelines, messaging matrices, and media plans.

4.2 Type 19 — Public Sector / Nonprofit / Governance

Delivers: governance reforms, program management, performance measurement

Clients: governments, NGOs, foundations

Size: 3–12 months

Fees: $100k–$1.5M

KPIs: program outcomes, cost-to-deliver, compliance metrics

Prereqs: public-sector procurement rules, grant/regulatory familiarity

Public-sector and nonprofit work emphasizes governance and program accountability. You’ll map programs, implement governance structures, and establish performance metrics that demonstrate outcomes and value.

4.2 Type 20 — Industry-Specialty Consulting

Delivers: domain-specific advisory, regulatory guidance, benchmarking

Clients: firms within target industry

Size: 2–12 months

Fees: $150k–$2M

KPIs: industry KPIs (e.g., ROE, LCOE, hospital metrics)

Prereqs: deep industry expertise, networks

Industry-specialty consulting leverages deep domain knowledge to deliver credible, authoritative guidance. You’ll benchmark performance, align regulatory considerations, and tailor recommendations to industry-specific drivers and metrics.

4.3 Type 20+ — Real Estate, Construction & Infrastructure

Delivers: project feasibility, cost-to-complete, risk management, procurement

Clients: developers, construction firms, public-infrastructure clients

Size: 3–18 months

Fees: $180k–$2.5M

KPIs: cost savings, schedule adherence, ROI on capital programs

Prereqs: sector-specific licensing, regulatory fluency

Real estate and infrastructure engagements emphasize capital planning, feasibility, and risk. You’ll assess cost-to-complete, forecast schedule adherence, and optimize procurement strategies to maximize ROI across complex programs.

5. Patterns you’ll see across all types

This section highlights recurring themes across the 20+ types to help you spot leverage points and build practical playbooks.

5.1 Engagement models that recur

Across these types you’ll see three core patterns: advisory-only engagements (strategy, governance), implementation/enablement work (IT, data platforms, change programs), and interim leadership or capability-building roles (CRO/COO data leader) or training. Each model serves different client needs and cash-flow profiles, but all share a clear outcomes-based mindset with defined milestones and predictable value delivery.

5.2 Common pricing and engagement sizes by category

Pricing scales with scope and risk. Mid-market engagements typically start in the six-figure range and span several months, while enterprise programs push into multi‑million figures for end-to-end transformations. Hybrids—combining multiple capabilities into bundles—are increasingly common, enabling cross-sell and higher utilization.

5.3 Cross-type synergies you’ll encounter

Hybrids are the norm. AI becomes a cross-cutting capability across strategy, risk, data governance, and operations. The strongest practitioners blend domain depth with change-management and data-enabled delivery to create differentiated offerings that accelerate delivery, deepen client relationships, and yield repeatable playbooks.

6. The score-based niche-selection framework (how to choose today)

This framework helps you pick a niche quickly and with confidence.

6.1 The scoring rubric

Create a simple rubric with criteria such as market demand, your domain strength, entry barriers, pricing potential, time-to-first-win, end-to-end delivery capability, competitive intensity, and regulatory considerations. Use a 0–10 scale for each criterion, and apply weights that reflect your priorities (e.g., faster wins get more weight).

6.2 How to apply the rubric in 60–90 minutes

List the top 6–8 niches, score each against every criterion, apply your weights, and total. The top 1–2 niches emerge as your candidates. This is a fast, practical way to prioritize where your confidence and network align with market pull, especially when you’re aiming to monetize online quickly.

6.3 Example niche scenarios and outcomes

Scenario A: Data governance in mid-market manufacturing—high demand, strong domain fit, moderate barriers; quick-win potential. Scenario B: AI strategy for SaaS startups—high upside but requires domain depth and vendor independence; longer ramp. Use these to stress-test your own entry points and ensure your scoring captures real-world dynamics.

6.4 90-day test plan to validate a chosen niche

- Week 1–2: define ICPs, craft service offerings, and set up a lightweight digital presence.

- Week 3–6: run 5–10 targeted outreach cycles, pilot advisory calls, or small engagements.

- Week 7–12: convert early pilots into paid engagements, refine pricing and messaging, and lock in at least one paid pilot with a repeatable delivery model.

7. Pricing, KPIs & go-to-market for online practice

This section translates your 20+ types into practical go-to-market and pricing decisions for an online practice.

7.1 Typical engagement sizes and fees by type

Engagements span roughly $75k–$1M+ per project, with durations from 1–18 months depending on scope. This range reflects the breadth of value you can deliver—from quick, targeted improvements to comprehensive transformations touching multiple functions.

7.2 KPI mapping by type (sample)

Strategy: ROI uplift, milestone achievement; Operations: cost and cycle-time improvements; IT: ROI and uptime/adoption; Data/AI: speed of insight and adoption; Pricing: margin lift; Branding: share of voice and engagement; Real estate: ROI on capital programs.

7.3 How to price for online delivery

Consider value-based pricing where possible, milestone-based payments for phase-based work, and retainer-plus-delivery models for ongoing advisory. Clear scoping, measurable milestones, and dashboards help justify premium pricing and reduce scope creep.

8. Launch playbook for an online consulting practice

A practical road map to get started and land the first paying clients.

8.1 Quick-start actions (first 30 days)

Narrow to 1–2 niches, build a simple service page, create a pricing ladder, and assemble playbooks and templates. Establish a crisp ICP and a lightweight outbound sequence to start generating inquiries.

8.2 Templates and IP you can reuse

Develop proposal templates, scoping templates, KPI dashboards, deliverable checklists, and onboarding playbooks. Reuse intellectual property across clients with appropriate tailoring to preserve credibility.

8.3 Go-to-market tactics

Leverage targeted outreach (LinkedIn, email), form alliances with adjacent service providers, publish concise content around the chosen niche, and pilot low-friction engagements to build proof points quickly.

9. Risks, barriers & ethical considerations

Navigate the practical and regulatory realities of online consulting.

9.1 Entry barriers by type

Barriers vary by domain: data access, regulatory constraints, senior client relationships, and sector-specific credibility. Plan to partner with clients who can sponsor data access and sponsorship.

9.2 Compliance, governance & data privacy

Compliance and governance are essential for regulated sectors and public-sector work. Establish robust governance, privacy controls, and transparent data handling from the outset.

9.3 Scaling considerations

As you scale, hire specialists with domain depth, develop standardized delivery playbooks, and design repeatable processes to maintain quality and client trust at scale.

10. Ready-to-use templates, rubrics & next steps

A compact kit you can deploy immediately.

10.1 1-page cheat-sheet template (for quick client outreach)

A concise service snapshot: problem statement, three measurable outcomes, engagement window, and a call-to-action for a discovery call.

10.2 Sample scoring rubric (0–10 per criterion)

A compact tool to compare niches quickly, with optional weights for priority criteria.

10.3 Ready-to-use niche scenarios and decision notes

Notes that capture how a chosen niche plays out in real client contexts, including a quick decision on proceeding to a pilot.

10.4 How to proceed if you want a tailored version

If you share your region, target segment, strongest domain, preferred engagement size, and any constraints, I’ll tailor the framework and deliver a concrete 90-day test plan.

References

- McKinsey & Company. Transformation and value realization insights. https://www.mckinsey.com/

- http://luisazhou.com/blog/types-of-consulting/

Hidden Yoast HTML comment block (mandatory; one block; at the very end; as HTML comment):